Some Known Factual Statements About Chapter 7 Vs Chapter 13 Bankruptcy

Table of Contents9 Simple Techniques For Chapter 7 Vs Chapter 13 BankruptcyNot known Details About Best Bankruptcy Attorney Tulsa The 8-Second Trick For Experienced Bankruptcy Lawyer TulsaThe Greatest Guide To Tulsa Ok Bankruptcy Attorney4 Simple Techniques For Chapter 13 Bankruptcy Lawyer Tulsa

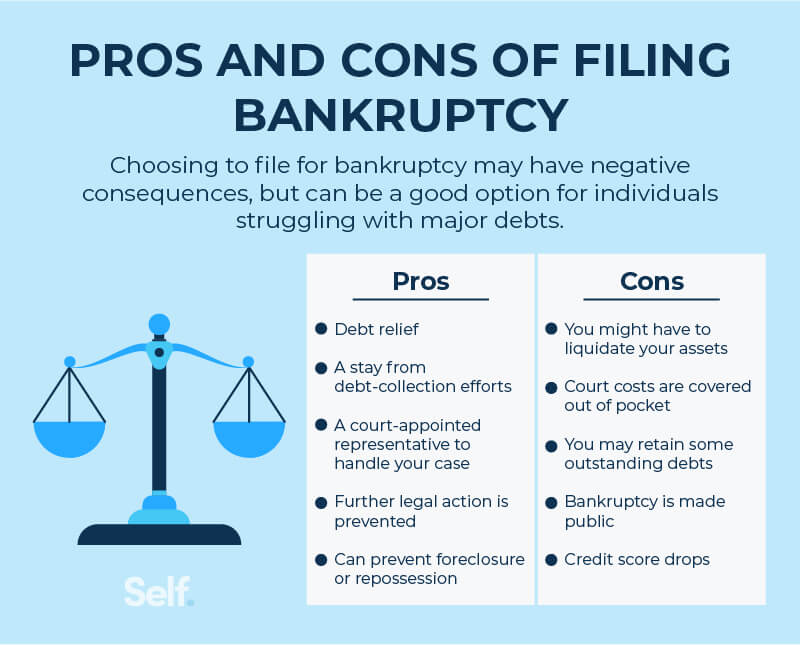

The stats for the other major type, Phase 13, are also worse for pro se filers. (We damage down the distinctions in between the 2 key ins deepness listed below.) Suffice it to say, speak to an attorney or 2 near you that's experienced with personal bankruptcy law. Right here are a couple of resources to find them: It's reasonable that you may be hesitant to spend for an attorney when you're already under substantial financial pressure.Many attorneys also supply free assessments or email Q&A s. Capitalize on that. (The non-profit app Upsolve can help you locate complimentary assessments, resources and legal assistance absolutely free.) Ask if bankruptcy is undoubtedly the right choice for your scenario and whether they believe you'll certify. Before you pay to submit personal bankruptcy kinds and blemish your credit history record for up to ten years, check to see if you have any kind of feasible alternatives like debt settlement or charitable credit history therapy.

Advertisements by Money. We may be compensated if you click this ad. Advertisement Since you've chosen bankruptcy is undoubtedly the right strategy and you ideally cleared it with an attorney you'll need to start on the documentation. Before you study all the main bankruptcy forms, you ought to get your very own records in order.

Our Tulsa Ok Bankruptcy Specialist Diaries

Later down the line, you'll really need to verify that by revealing all type of information about your financial affairs. Right here's a fundamental checklist of what you'll need when traveling ahead: Recognizing documents like your driver's certificate and Social Safety card Income tax return (approximately the past four years) Proof of earnings (pay stubs, W-2s, self-employed revenues, revenue from properties along with any type of earnings from federal government advantages) Bank declarations and/or pension statements Evidence of worth of your properties, such as lorry and actual estate assessment.

You'll desire to comprehend what kind of financial debt you're attempting to solve.

You'll desire to comprehend what kind of financial debt you're attempting to solve.If your earnings is expensive, you have another alternative: Chapter 13. This option takes longer to resolve your debts since it calls for a lasting repayment plan typically 3 to 5 years prior to some of your remaining financial obligations are wiped away. The filing procedure is additionally a whole lot a lot more intricate than Chapter 7.

The Chapter 13 Bankruptcy Lawyer Tulsa Statements

A Chapter 7 insolvency remains on your credit scores report for 10 years, whereas a Phase 13 personal bankruptcy drops off after 7. Both have lasting influence on your credit report, and any brand-new financial debt you secure will likely include greater rate of interest. Before you send your insolvency forms, you need to first finish a required course from a credit therapy firm that has been authorized by the Department of Justice (with the significant exception of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. Programs typically cost between $15 and $50. You have to finish the program within 180 days of declare bankruptcy (Tulsa OK bankruptcy attorney). Make use of the Division of Justice's web site to find a program. If you stay in Alabama or North Carolina, you should pick and complete a course from a listing of independently approved providers in your state.

The 25-Second Trick For Tulsa Bankruptcy Filing Assistance

Examine that you're filing with the proper official statement one based on where you live. If your long-term residence has actually relocated within 180 days of filling, you ought to submit in the area where you lived the greater portion of that 180-day duration.

Typically, your insolvency attorney will certainly collaborate with the trustee, however you may require to send the person files such as pay stubs, tax obligation returns, and bank account and credit card declarations directly. The trustee who was just appointed to your case will certainly quickly establish a required meeting with you, called the "341 meeting" because it's a demand of Section 341 of the U.S

You will need to provide a prompt list of what certifies as an exemption. Exemptions may apply to non-luxury, key lorries; required home products; and home equity (though these exceptions rules can vary commonly by state). Any type of property outside the checklist of exceptions is thought about nonexempt, and if you do not provide any listing, then all your building is taken into consideration nonexempt, i.e.

You will need to provide a prompt list of what certifies as an exemption. Exemptions may apply to non-luxury, key lorries; required home products; and home equity (though these exceptions rules can vary commonly by state). Any type of property outside the checklist of exceptions is thought about nonexempt, and if you do not provide any listing, then all your building is taken into consideration nonexempt, i.e.The trustee would not sell your sports vehicle to instantly repay the creditor. Instead, you would pay your creditors that quantity throughout your layaway plan. An usual misconception with bankruptcy is that as soon as you submit, you can stop paying your financial obligations. While insolvency can aid you eliminate a number of your unsecured debts, such as overdue clinical costs or individual fundings, you'll wish to keep paying your monthly repayments for protected financial obligations if you wish to keep the residential or commercial property.

The Only Guide for Tulsa Ok Bankruptcy Specialist

If you go to threat of repossession and have actually tired all various other financial-relief options, after that declaring Chapter 13 might postpone the foreclosure and assist in saving your home. Inevitably, you will certainly still require the earnings to continue making future home mortgage repayments, in addition to repaying any kind of late settlements over the program of your settlement strategy.

The audit might postpone any debt relief by several weeks. That you made it this much in the procedure is a reference suitable sign at least some of your debts are qualified for discharge.